In today's fast-paced economy, maximizing your credit card rewards can significantly enhance your financial well-being. Understanding how to leverage the benefits of your credit card allows you to earn cash back, travel points, or other rewards that can provide substantial value.

This article will explore six effective strategies that can help you maximize your credit card rewards, ensuring that you get the most return on your spending.

1. Understand Your Card’s Reward Structure

Before you can start reaping the benefits of your credit card rewards, it is crucial to understand the specific structure of the rewards your card offers. Different cards come with various reward systems, such as cash back, points, and miles, each suited for different spending habits.

Pay attention to the categories where you earn more rewards. Some cards may offer higher rewards on groceries, gas, or dining, while others may excel in travel bonuses.

- Check the reward types: cash back, points, or miles.

- Identify bonus categories and limit spending to those areas.

- Read the terms and conditions regarding earning thresholds.

- Look for expiration dates on rewards.

2. Take Advantage of Sign-Up Bonuses

Sign-up bonuses are one of the most lucrative ways to kick-start your rewards accumulation. Many credit cards offer generous bonuses for new cardholders who meet certain spending requirements within the first few months.

By strategically timing your large purchases to coincide with your new card acquisition, you can significantly inflate your rewards balance early on.

- Research cards with the best sign-up bonuses.

- Evaluate the spending requirement to earn the bonus.

- Plan your expenses to meet the requirement within the timeframe.

- Set reminders to track your spending and ensure you hit the goal.

Taking full advantage of sign-up bonuses can often lead to thousands of points or dollars in rewards that can be redeemed for travel, merchandise, or cash back.

3. Use the Right Card for the Right Purchase

Successful navigation of credit card rewards requires knowing which card to use for which type of purchase. Different cards often provide better rewards in specific categories, making strategic use essential for maximizing returns.

Evaluate your spending habits and categorize them. This will help you choose the card that delivers the maximum rewards for each purchase.

- Use a specific card for groceries to earn cash back.

- Select a travel rewards card for airline tickets and hotel bookings.

- Utilize cards with rotating categories to stay current with your spending.

- Track your points and cash back rates to see which cards yield higher rewards.

By using the correct card for the appropriate purchase, you ensure that you are taking full advantage of the rewards structure set by your cards.

4. Pay Your Balance in Full Each Month

To fully benefit from your credit card rewards, it's vital to pay off your balance in full each month. This practice prevents interest charges from erasing the benefits you gain from rewards, as carrying a balance usually incurs high interest rates.

Additionally, maintaining a low credit utilization ratio by paying your balances can positively affect your credit score, allowing you to qualify for better cards and rewards in the future.

- Set up automatic payments to avoid missing due dates.

- Create a budget to manage spending effectively.

- Keep track of your purchases for better financial oversight.

- Consider utilizing apps to help monitor your credit card usage.

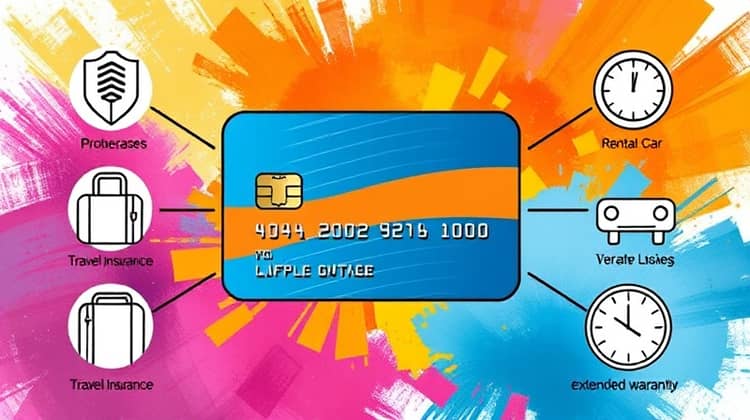

5. Explore Additional Benefits

Credit cards often come with additional benefits beyond just rewards points or cash back. These perks can add significant value to your card usage, often without any extra cost to you. Open your account terms and look for any hidden gems.

Some common benefits include extended warranties, purchase protection, and travel insurance. By leveraging these benefits, you can enhance your overall experience and value derived from your credit card.

- Look for travel protection features, such as trip cancellation insurance.

- Check if your card offers rental car insurance.

- Investigate purchase protection for high-value items.

- Utilize extended warranty coverage on eligible purchases.

6. Combine Rewards with Other Programs

Many credit card companies allow you to combine rewards with airlines, hotels, or other loyalty programs, which can further maximize your rewards potential. By aligning your credit card spending with these programs, you can accelerate the accumulation of rewards.

Make sure to do your research about which programs can be linked and any restrictions that may apply to ensure you are not missing out on additional earning opportunities.

- Transfer points from your credit card to airline or hotel partners.

- Sign up for loyalty programs that offer bonus points for credit card holders.

- Stay informed about promotional partnerships that may enhance rewards.

- Consider using shopping portals that offer extra points for purchases.

Conclusion

Maximizing credit card rewards requires strategic planning and awareness of your spending habits, but the effort can result in significant benefits over time. Implementing these six strategies can help you boost your rewards and make the most out of your purchases.

By understanding your card's structure, leveraging sign-up bonuses, using the right card for the right spend, paying bills in full, exploring extra benefits, and combining rewards with other programs, you set yourself on a path towards financial efficiency.